More Americans are draining their 401(k) as the purchasing power of the dollar plummets.

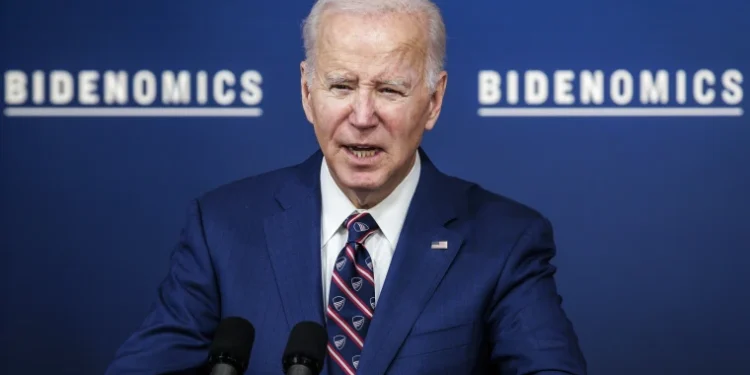

The Presidential campaign is in full swing, but the state of affairs in the United States is troubling to those Americans struggling financially. The average American is in financial distress and inflation due to policies like “Bidenomics” enhancing the issue.

Since January 30, 2020, aggregate inflation rate has hit 25% effectively reducing the value of today’s dollar to 75 cents. But it is not just higher prices stoking Americans’ monetary woes. Savings rates have plummeted and an unprecedented surge in consumer debt means more Americans living paycheck to paycheck and retirement is no more than a fantasy.

To cope with these financial challenges, many Americans are resorting to draining their savings accounts and swiping their credit cards. According to Bank of America, over one third of clients’ dug into their 401(k) to make ends meet. Meanwhile, total US credit card debt has reached a historic peak exceeding $1 trillion.

Americans are spending more, earning less, and being forced to dip into savings to cover the difference.

So much for dream of retirement.

The impact of Bidenomics is particularly severe on retirees and those with fixed incomes.

This year, Social Security recipients received a 3.2% increase, averaging $59 per month. This small increase does not even keep up with inflation. NBC Reports “Since mid-2020, average prices in the U.S. have climbed more than 20%. Yet, the total Social Security cost-of-living adjustment has increased just over 17.8% over the same period of time.”

Americans who worked hard their entire life expect things like Social Security and the company 401(k) to ensure a secure retirement but they are now confronted with a harsh reality. According to Gallup only 43% of today’s workers believe they will be able to live comfortably in retirement while 71% are worried about having enough money for retirement. Inflation is eroding the financial stability of today’s retirees and depleting the savings of the working population before they even reach retirement age.

Is “Bidenomics” pushing the average American to postpone retirement and for many workers? It has yet to be seen if the prospect of the golden years may disappear altogether, but we can remain hopeful.